Micah Hobart, COO

Nonprofit Reporting: Why do your bank account, Donor CRM and accounting software all have discrepancies in reporting?

One of life’s great mysteries is trying to decipher your merchant services account(s), bank account(s), accounting software and your Donor CRM reports so that your organization can simply report accurately to your donors and the IRS. And with the ever-increasing complexity of multi-channel communications and opportunities for making a donation to your organization, this once simple task can cripple an organization if not carefully thought through.

So where does a nonprofit start to accurately reconcile their credit card activity?

Start at the beginning! What we mean by this is tracking a donation from beginning to end in each of the various ways a constituent can make a donation to your organization. Usually this means making a unique donation through the mail, over the telephone, at an event and online. And increasingly this also means a donation through Text2Give, social media (Facebook, Twitter) and through other various online methods (giving via email, giving via various landing pages, and giving via your main donation page). For some organizations this may also mean purchasing a product (i.e. a book, a digital download, etc.) as well. By starting here and targeting each donation as a unique donation and tracking them through the entire process (all the way to the bank statement), the mystery will begin to be unraveled.

Second, track the donations your organization received. Look for donation notifications (both simple automated email receipts as well as formal database driven thank you’s) from your organization. Also, watch your bank accounts and credit card accounts for debits to hit your accounts. These all indicate the timing in which the various donations will be processed. Oftentimes, there will be delays with donations made not only via the US Postal mail but also via telephone.

Third, look for the credits to hit your bank account. Ultimately, a donation is not a donation until it's deposited into your organization's bank account.

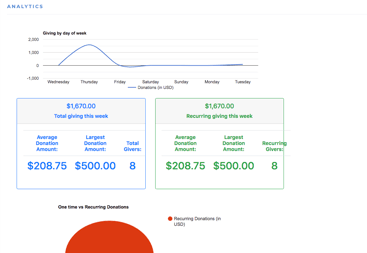

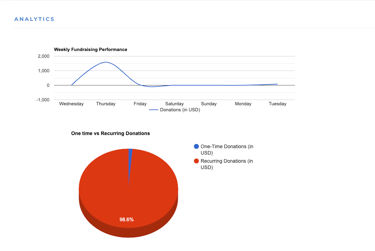

Next (here’s the fun part), run reports! Usually this means running numerous reports from various areas. Of course, your accounting software and Donor CRM and your bank all have standard reports. However, don’t overlook merchant services reporting!

Finally, AUDIT! By tracing the unique transaction amounts starting at the beginning and conducting a good old-fashioned audit, these routine practices usually gives an organization the insight needed into discerning where the problem lies. The reports from the various entities ought to tie in easily for your auditing process.

Are there any usual suspect areas of reporting confusion?

Of course! Oftentimes, organizations will launch a new fundraising initiative, but not comprehensively and strategically include all aspects of the financial reporting side of the organization. This means that duplicated and redundant business services and/or processes are launched. Things like new bank accounts, additional merchant accounts, or stand-alone reporting are part of the new initiative and that creates a bottleneck in reporting reconciliation.

In some instances, a new vendor may be hired by your nonprofit, but not have the capability to support all areas of your fundraising and development activities. Banks and merchant services vendors commonly struggle with accommodating a wide variety of fundraising means. Instead, new bank accounts and new merchant accounts are opened up resulting in duplicated and redundant services as well as increased organizational costs.

Any recommended solutions for avoiding a reconciliation bottleneck?

Choose vendors wisely! Banks and merchant service providers should be chosen and have the flexibility and expertise to work with charities and the various fundraising strategies your organization uses...the same goes for your Donor CRM and your web/technology platform. Don’t rush into new fundraising initiatives without strategically thinking through reporting. Sometimes the fundraising initiative is intentionally a one-off development program...in those cases, it’s fine to implement them quickly without automating everything. However, for those fundraising initiatives that are going to stick around and be part of your ongoing development program, they should be integrated into your CRM and accounting systems. The best practice (to avoid a reconciliation bottleneck) is to work from the reconciliation stage backwards (i.e. reverse engineer) so that your donation pipeline has the proper coding and staging to ensure a more seamless data flow between the fundraising and reconciliation process.

With Paperless Transactions, our team and staff has decades of company experience in working through the unique reconciliation challenges that nonprofits face and we are here to help your nonprofit. To learn how we can help your organization audit your reconciliation process (no strings attached), click below and we'll perform a complimentary audit for you.